- Financial Insights

- News

- Commentary

- News & Commentary

- 28 min read

Clarendon Private Financial Insights – August 2022

Near-Term Pain for Long-Term Gain

- By: Clarendon | PRIVATE

- August 08, 2022

Quarterly Review & Outlook Q2 2022

Near-Term Pain for Long-Term Gain

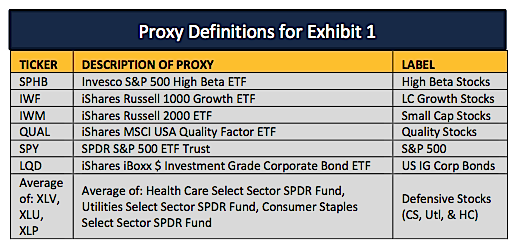

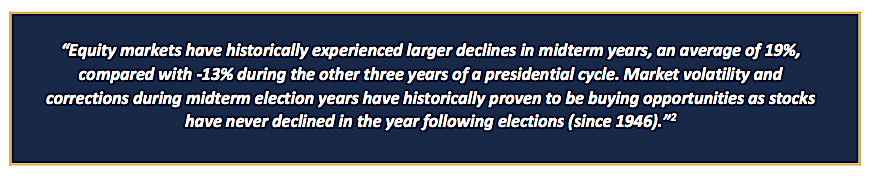

The selloff in stocks and bonds accelerated during the second quarter, and the S&P 500 declined by -20% through June, the worst start since 1970. Bond prices also declined as rates increased (bond prices move inversely to rates) with the 5-year U.S. Treasury yield ending June at 3.0%. Investment grade corporate bonds are down nearly 17% year-to-date. This was just the fifth time since 1976 that stocks and bonds posted negative returns for two consecutive quarters and the first time in history that stocks and bonds have been down 15% or more at the same time. Exhibit 11: Risk off with defensive leadership During Q2, quality and defensive stocks outperformed cyclicals, growth, and high-beta stocks (Exhibit 11). This is consistent with the view we outlined last quarter for continued defensive leadership amid slowing earnings growth. Recessionary fears increased as central banks embraced a more aggressive stance to curtail inflation. As we highlighted in April, midterm election years have historically been the most volatile of the four- year presidential cycle. The pattern has continued with a 20% decline during the first half of the year.

A Proven Process for Turbulent Times

In what has been a historically challenging market environment, Clarendon has proactively provided downside protection relative to passive equity and fixed income strategies through both top-down allocation decisions and bottom-up security selection.

1 FactSet

2 Strategas

Clarendon Private LLC is a registered investment advisor and a subsidiary of Brookline Bancorp | Copyright 2021 See appendix for asset class/sector proxies.

Our research-driven investment process marries our assessment of industry and company fundamentals with macro and scenario analysis. We are long-term investors with an average holding period of four years. Our disciplined approach allows us to take advantage of market dislocations and time arbitrage to deliver long- term returns. We focus on owning high-quality investments – which we define as offering strong or improving returns on capital, sustainable free cash flow growth, shareholder-oriented management, and stable balance sheets.

One of the bright spots amid the broad selloff across global asset classes is that prospective long-term returns have improved considerably as a result of (1) higher bond yields and (2) lower equity valuations. Notably, inflation expectations for the next five years have recently declined from 3.6% per year to 2.6%3, which implies better real (after-inflation) returns as well.

We highlighted in our 2022 outlook that equity volatility was likely to increase as a result of persistent inflation and less accommodative Fed policy, and we have tactically adjusted portfolios accordingly. Over the past several months, we have been trimming exposures to cyclical businesses with revenues tied to steel production, discretionary spending, and housing in favor of increasing positions in high-quality cash generators across the consumer staples, health care, and REIT sectors. While these positions have not been immune to equity market stress, they have generally outperformed the broader market, cyclicals, and money-losing technology stocks. U.S. small cap stocks declined by 17.3% in Q2 while non-U.S. stocks fell by 12.4%. A strong U.S. Dollar has been a headwind to international stocks this year.

1 FactSet

2 The Irrelevant Investor

3 Federal Reserve Bank of St. Louis

Given the historic weakness in fixed income markets this year, traditional 60/40 portfolios have struggled (Exhibit 411). Clarendon was bearish on long-duration bonds coming into 2022 as the 10-year U.S. Treasury yielded just 1.5% on 12/31/2021 and spiked to 3.0% at the end of Q2. Our balanced accounts have benefitted from our preference for much shorter maturity fixed income allocations that have outperformed longer duration bonds. Following the spike in rates (and gradually declining inflation expectations) we have been more constructive on certain areas of fixed income than any period since 2019.

Headwinds to House and the Consumer

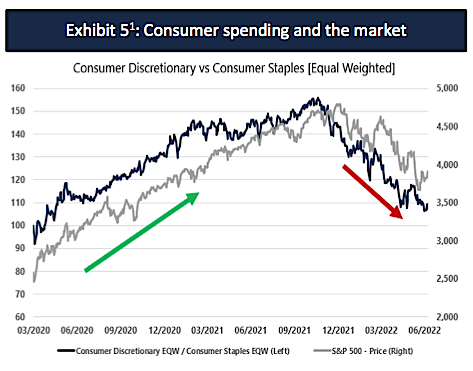

In addition to the defensive leadership shown in Exhibit 1, another relationship we monitor to glean a forward- looking message from the market is the behavior of consumer discretionary stock prices relative to consumer staples stocks. The latter tend to be comprised of products and services with more stable demand regardless of the economic outlook (toothpaste, soap, snacks) while discretionary goods are more impacted by the cyclicality of consumer spending.

During the spring of 2020 (peak COVID-19 lockdowns), discretionary stocks began to outperform staples and proved to be a prescient early signal of the subsequent economic and market recovery (Exhibit 51 – green arrow). Conversely, the ratio flipped and began to signal an economic slowdown earlier this year. We continue to expect a slowdown in earnings growth in the coming months, particularly given the acute, but lagged, impact that changes in monetary policy (and interest rates) have on growth. For example, the 5-year U.S. Treasury yield has spiked from 0.99% to 3.0% over the past nine months, and the impact of higher rates will likely remain a near-term headwind to earnings growth.

1 FactSet

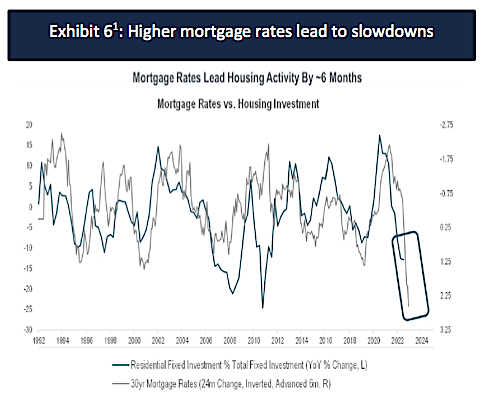

Housing activity is another reliable leading indicator of economic growth that is also disproportionately impacted by rising rates. Last quarter, we highlighted our expectation of a housing slowdown (driven by rapidly rising rates) that had yet to materialize in the data. During Q2, housing activity declined significantly as 30-year mortgage rates doubled from recent lows to above 6%, the highest levels since 2008. Exhibit 61: Higher mortgage rates lead to slowdowns

Mortgage demand declined to the lowest level in twenty-two years and the National Association of Home Builders (NAHB) Housing market index collapsed in July to 55, the lowest level since June of 2020. The 12-point decline from the prior month was the largest on record except for April 2020 during the COVID-19 lockdown.

Housing is not only an important engine of economic growth and job creation in the U.S., it is also the largest component of consumer net worth. As such, it is a key factor in the “wealth effect” - a behavioral theory that suggests people spend more as the value of their assets (homes, stocks, etc.) rise and vice versa. The lagged effect of higher rates suggests more weakness ahead for housing (Exhibit 61) and the consumer.

Inflation and the Fed

The dual mandate of the U.S. Federal Reserve includes pursuing the economic goals of maximum employment and price stability. Given the ongoing strength of the U.S. labor market, the Fed is keenly focused on improving price stability. Currently, quantitative tightening (a reduction in the Fed’s balance sheet that decreases money supply) and raising the Fed funds rate are the primary tools being employed to curtail inflation. Two key points to consider (1) the Fed underestimated the persistence of inflation and (2) the strength of the labor market makes their ability to solve the inflation problem more challenging than any cycle in decades.

Investors have begun to discount the idea that the spike in mortgage rates will result in a severe enough housing downturn to allow the Fed to pivot to a less hawkish stance. The futures market is pricing in Fed rate cuts in Q1 of 2023. We agree that housing activity will continue to slow, and that the level of inflation is likely to decline as we move through the year. However, with core inflation at 6% amid a strong labor/wage environment, it is still a long way to the Fed target of 2%, which will require time. Conversely, in 2018 when the Powell-led Fed made its dovish pivot, inflation had already eased back below the 2% target.

1 Piper Sandler

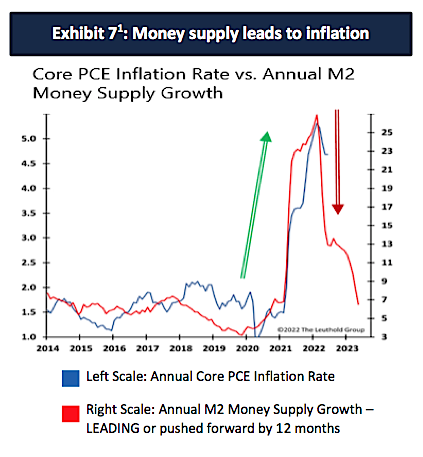

Tighter financial conditions have presented a significant headwind to stocks as inflation-adjusted U.S. money supply growth (measured by “M2”) turned negative in Q2 for the first time in twelve years. Exhibit 71 illustrates the relationship between M2 growth and core inflation. Changes in M2 growth lead inflation by about twelve months. Unprecedented monetary policy in early 2020 led to a historic increase in money supply and subsequent spike in inflation. The rapid shrinking of liquidity suggests lower inflation in the coming year.

Commodities are a key driver of inflation and were the best performing asset class in in first half of 2022, +18.4% (Bloomberg Commodity Index), due to supply-demand imbalances and the war in Ukraine. However, even with this favorable backdrop, commodities declined sharply (-10.9%) during the month of June on fears of a global economic slowdown.

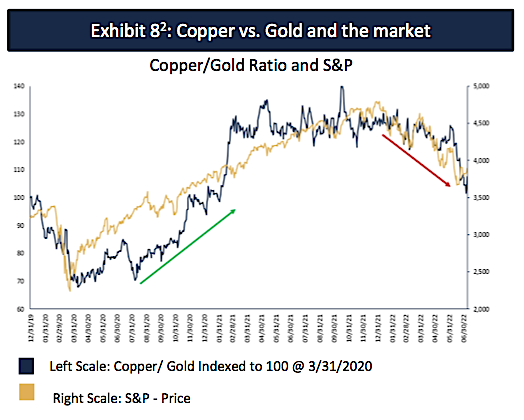

Comparing the ratio of copper prices to gold can be a helpful gauge of the future direction of economic growth (Exhibit 82). The recent decline in copper prices, a proxy for global economic growth, portends further weakness, while the relative strength of gold prices suggests caution is warranted. The recent price action is in stark contrast to the onset of the pandemic during the spring of 2020 when copper prices were rising rapidly relative to gold - and accurately predicted the ensuing economic and market recovery. We favored cyclical and inexpensive growth stocks at that time, whereas this year we have been reducing cyclicals in favor of more defensive sectors and high-quality dividend growth stocks.

1 The Leuthold Group 2 FactSet

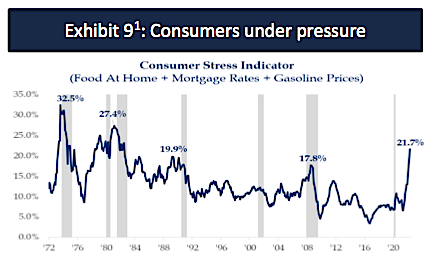

The combination of higher mortgage rates, elevated commodity prices, and stubborn inflation is creating a significant strain on the U.S. consumer (Exhibit 91). As a result, consumer confidence has recently reached all- time lows (including the great financial crisis) and poses a headwind to spending and earnings growth. Consumer spending accounts for nearly 70% of U.S. GDP.

What Now?

With the average stock having corrected by nearly 30% and bond yields materially higher, prospective long- term returns have improved significantly from recent highs. When investors sell assets indiscriminately regardless of quality or value, that is when great opportunities arise.

We expect continued volatility near-term as the lagged impact of rising rates will remain a headwind to growth in an already slowing economy. Importantly, despite slower growth and a potential recession, our view is that a lot of bad news is priced into certain stocks following significant price declines. A disciplined research process with a long-term focus is well positioned to take advantage of the current market dynamics.

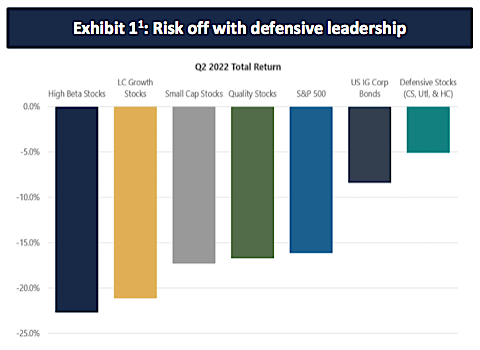

In addition to more attractive valuations, the election cycle becomes more favorable this fall. As we highlighted last quarter, the period leading up to midterm elections (including 2022 YTD) has historically been the worst of the four-year election cycle, as investors contemplate political uncertainty. However, with history as a guide, during the twelve months following the midterms (November), equity returns have been consistently above average. The S&P 500 has been positive in the year after midterms in every instance since 1946, with an average one-year return of 15.1%, versus the market’s 9.1% average long-term annual return.

The election cycle and moderating inflationary pressures over the coming year are likely to result in a better environment for stocks. A weaker U.S. dollar could also become supportive of stocks - according to Fidelity, peaks in the U.S. dollar over the past forty years have been followed by an average return of 10% in the next twelve months for the S&P 500.

1 Strategas

The Punch Line

The second quarter of 2022 was one of the most challenging periods for stocks and bonds in decades. Risks increased as investors considered the implications of persistent inflation, the ongoing Russia-Ukraine conflict, and an increasingly hawkish U.S. Federal Reserve. The S&P 500 declined by 20% during the first half of the year for the worst first half in more than fifty years.

Last quarter, we outlined our expectation for continued volatility, a more aggressive Fed, and weaker than expected earnings growth. Over the past several months, we have been trimming exposures to cyclical businesses with revenues tied to steel production, discretionary spending, and housing in favor of increasing positions in high-quality cash generators across the consumer staples, health care, and REIT sectors. Our balanced accounts have benefitted from our preference for much shorter maturity fixed income allocations that have outperformed longer duration bonds amid the spike in rates.

The increase in yields and decline in equity valuations during the first half of this year has significantly increased our expected long-term returns for stocks and bonds. Reaching the Fed’s inflation target will take time, but moderating inflationary pressures and a weaker U.S. dollar could also provide a tailwind to stocks.

As always, we welcome the opportunity to discuss how we can help clients to achieve their long-term financial goals.

Disclosures

The information provided is illustrative, for educational and informational purposes only, does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. All investments include a risk of loss that clients should be prepared to bear. The principal risks of Clarendon Private strategies are disclosed in the publicly available Form ADV Part 2A.

Clarendon Private, LLC (“Clarendon Private”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Clarendon Private and its representatives are properly licensed or exempt from licensure.