- Financial Insights

- News

- Commentary

- News & Commentary

- 35 min read

Clarendon Private Financial Insights – May 2022

Nowhere to Hide: The first quarter of 2022 was the worst quarter across asset classes, except commodities, since Q3 1981.

- By: Clarendon | PRIVATE

- May 05, 2022

Quarterly Review & Outlook Q1 2022

Nowhere to Hide

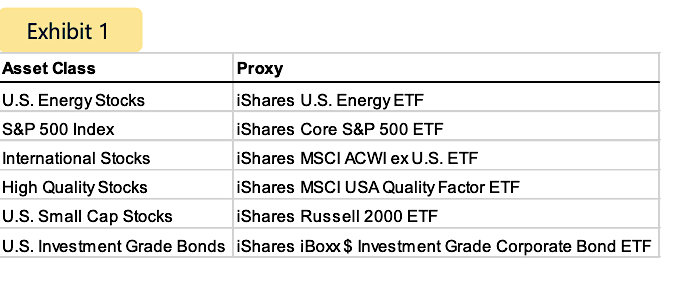

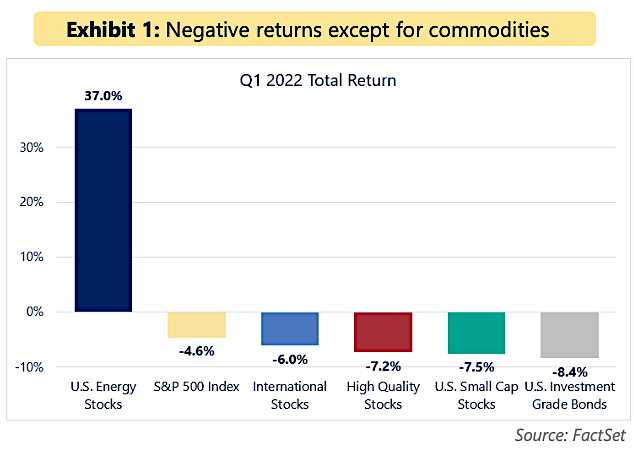

The first quarter of 2022 was the worst quarter across asset classes, except commodities, since Q3 1981¹. This was just the 19th time, out of 185 quarters, since 1976 when both stocks and bonds posted negative quarterly returns, and just the 3rd occurrence since the 2008 financial crisis². The S&P 500 declined by 4.6% and notable changes in market leadership highlighted the evolving fundamental backdrop. High quality stocks and investment grade bonds underperformed during the selloff, as commodities posted their best quarter on record (Exhibit 1).

Persistent inflation caused the market to discount more aggressive rate hikes and quantitative tightening from the U.S. Federal Reserve (Fed). In our investment outlook for 2022 we highlighted our expectation for higher volatility in the coming year:

“We continue to see inflationary pressures as the key risk over the coming year...the yield curve will likely come under flattening pressure,” and that less accommodative Fed policy would become “a headwind to equities, similar to 2018, which led to a 20% correction in the S&P.”

Sure enough, risks rose during the quarter as investors were forced to consider the implications of sustained inflationary pressures, the Russia-Ukraine conflict, and an increasingly hawkish U.S. Federal Reserve.

While the index fell 4.6% during Q1, the average stock in the S&P 500 declined more than 20% from 52-week highs through March 8th, and the average large cap growth stock was -33%. The Q1 spike in rates (10-year Treasury yield increased from 1.5% to 2.3%) reset valuations, particularly for the most expensive growth stocks whose valuations are more sensitive to changes in rates: the average stock in the Nasdaq declined by 46% from its 52-week highs as of March 8th. In addition, there were 12 consecutive weeks where the Nasdaq experienced at least three 1% daily moves (Exhibit 2 on page 2).

Clarendon Private LLC is a registered investment advisor and a subsidiary of Brookline Bancorp | Copyright 2021. ¹Source: Ned Davis Research. ² Source: Strategas. See appendix for asset class/sector proxies.

Since 1980, the S&P 500 has generated a 9.4% annualized return despite experiencing an average intra-year decline of 14%. The index has managed to produce positive annual returns in 32 of 42 years (76% of the time)¹. Corrections are a normal and healthy aspect of market cycles that curb excesses and create opportunities for disciplined investors.

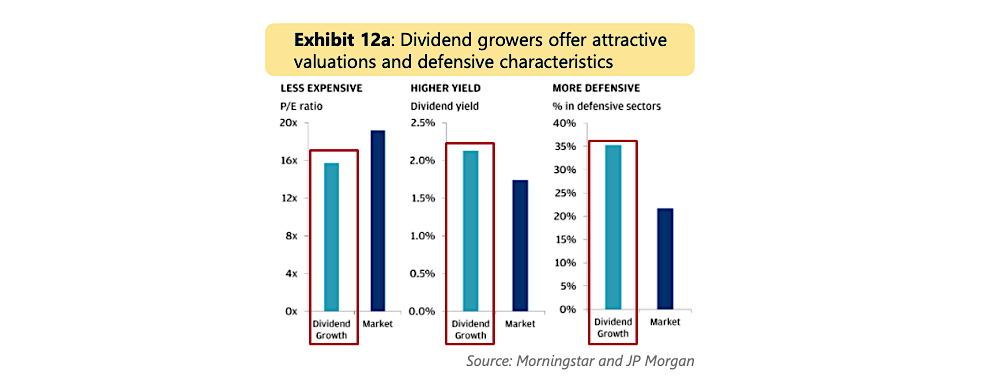

While we expect continued market swings in the near-to-intermediate term, the ongoing selloff has created attractive opportunities, particularly in high-quality dividend growth stocks. Looking out 12 to 18 months we are constructive on equities as valuations are improving and certain measures of investor sentiment have become quite negative. A recent reading of the AAII investor sentiment revealed the fewest bullish respondents in 30 years. This has historically been a good contrarian indicator, which has preceded 10% forward 12-month returns for the S&P 500 during Fed tightening cycles.

While we expect continued market swings in the near-to-intermediate term, the ongoing selloff has created attractive opportunities, particularly in high-quality dividend growth stocks. Looking out 12 to 18 months we are constructive on equities as valuations are improving and certain measures of investor sentiment have become quite negative. A recent reading of the AAII investor sentiment revealed the fewest bullish respondents in 30 years. This has historically been a good contrarian indicator, which has preceded 10% forward 12-month returns for the S&P 500 during Fed tightening cycles.

Market corrections can be unnerving, but it is important to consider the recent market volatility in context. March 23rd marked the 2-year anniversary of the market low during COVID. Since the 2020 bottom, the S&P 500 is up 109% through 3/31/2022 and +48% since 12/31/19, prior to the onset of the global pandemic. Despite the volatility, the index was within 5% of the all-time high at quarter-end, and has doubled at the fastest rate in post-war history (Exhibit 3).

An additional factor contributing to equity market volatility is the U.S. midterm election cycle. Equity markets have historically experienced larger declines in midterm years, an average of -19%, compared with -13% during the other three years of a presidential cycle (Exhibit 4). Market volatility and corrections during midterm election years have historically proven to be buying opportunities as stocks have never declined in the year following elections (since 1946). Why? Following midterm elections, the market begins to discount more stimulus as policymakers seek to improve the economy ahead of the presidential election.

Historically, the Fed has tightened policy too aggressively prior to midterms and then pivots to cutting rates the following year. The midterm year of 1982 offers an interesting analogue given (1) the eerily similar Q1 performance (2) Q1 1982 was the last time the U.S. was contending with extreme inflation, Russian conflict (Cold War), and midterm elections at the same time (Exhibits 5a and 5b).

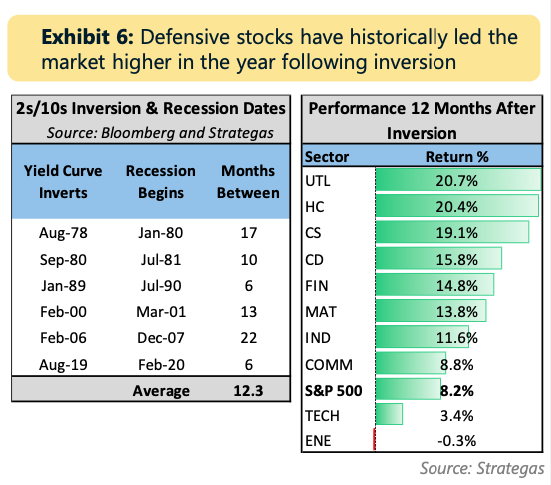

Yield Curve Inversion

Inflation

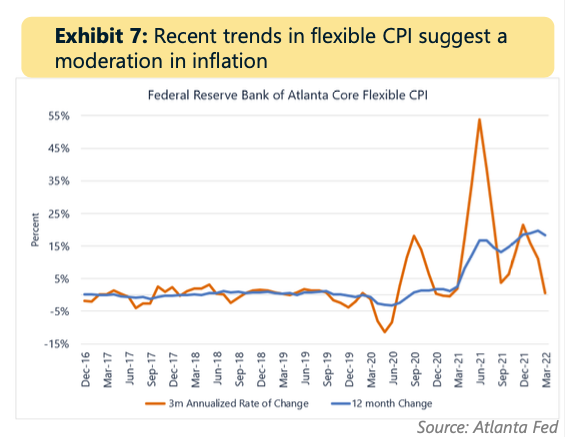

Our view coming into the year was that inflation remained the key risk to equity and bond markets. Due to a host of factors – supply chain disruptions, labor shortages, Russian invasion, unprecedented fiscal policy and money supply – prices have continued increasing at a pace not seen since the 1980s. This has forced the Fed to remove accommodative monetary policies more aggressively than expected. Despite the March CPI of +8.5%², there are signs that inflation may be peaking.

The chart to the right shows the 3-month rate of change for the (flexible) core CPI in orange with the 12-month rate of change in blue. Flexible CPI is often a reliable leading indicator for the sticky CPI. When flexible prices start declining, stickier goods prices tend to follow. This chart suggests the flexible CPI peaked and is trending down - which argues for lower inflation in the coming months - albeit still above the trend of the past decade. The 5-year breakeven rate (the bond markets’ view on inflation in the coming 5 years) has declined from 3.57% to 3.37% in less than a month.

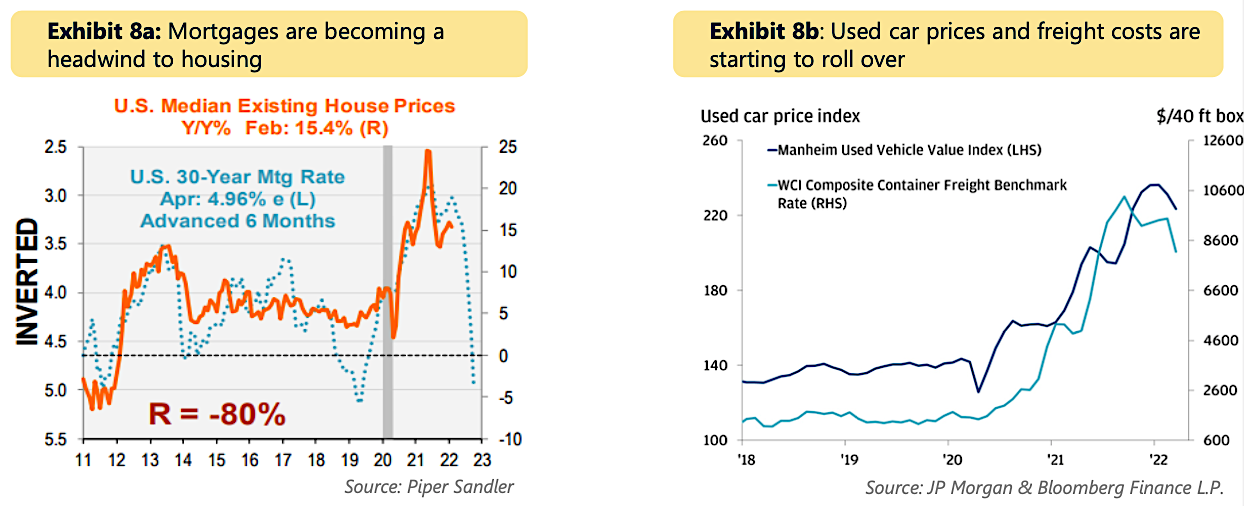

Used car prices and freight rates are now declining, following historic increases from 2020-2021. In addition, wage growth is slowing and the sharpest rise in mortgage rates since 1994 has driven housing affordability to its lowest level in 14 years. This will gradually impact home prices and recent data from Zillow suggests that the worst of rental inflation is also behind us (Exhibits 8a and 8b).

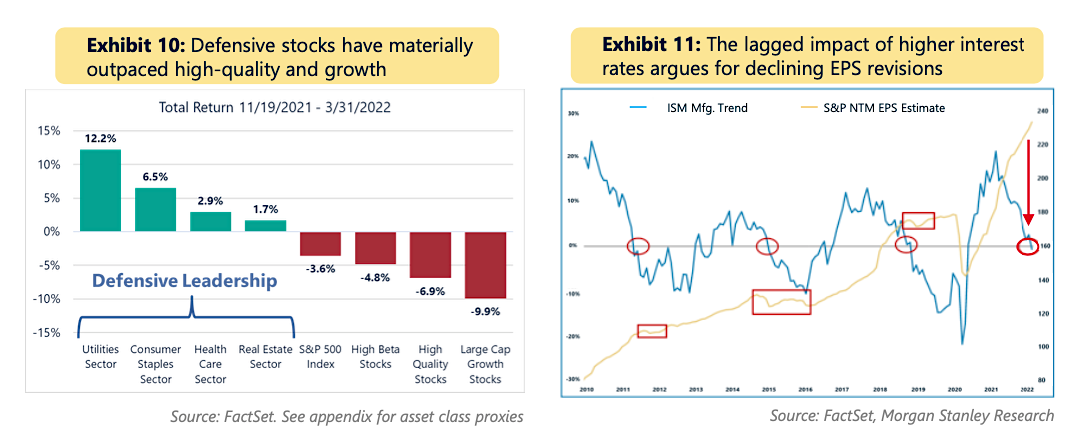

Housing is a key driver of the economy and U.S. consumer (wealth effect). The message from housing stocks is that there is a slowdown ahead. The lagged impact of a spike in interest rates over the past 2 years is also weighing on manufacturing activity (PMI) and suggests decelerating EPS growth (Exhibit 11).

Opportunities amid uncertainty

As the market transitions to the later stages of the economic cycle, adapts to ongoing inflationary pressures, and contends with a hawkish Fed, we see the best opportunities being comprised of:

-

High-quality businesses with pricing power and stable free cash flow growth

-

Companies with growing dividends that can help to offset inflation

-

Some cash to be opportunistic in an increasingly volatile market

Sources: FactSet, Morgan Stanley, and Morningstar.

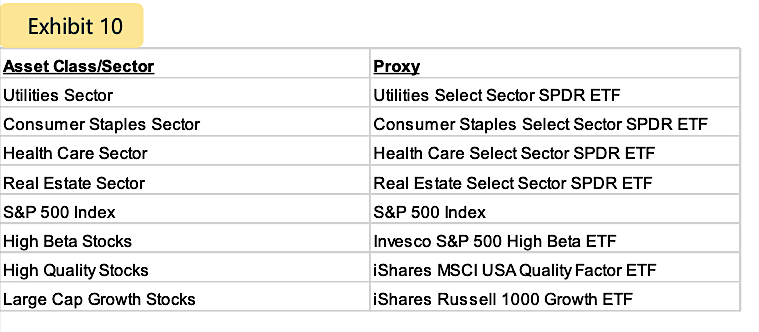

In the early part of the cycle (2020-2021) we favored a balance of quality dividend growth stocks combined with higher- beta cyclicals that were poised to disproportionately benefit from an economic recovery. From 3/23/20 through 12/31/21 high-beta stocks were +216% versus the S&P 500 +113%. As we transition to the later stages of the cycle we have been reducing exposure to high-beta stocks in favor of higher quality companies with more stable (less cyclical) cash flow growth (Exhibit 12b).

Sources: FactSet ¹based on ticker LQD – iShares iBoxx Investment Grade Corporate Bond ETF

Conclusion

The first quarter of 2022 was one of the most challenging environments across asset classes in decades. Risks increased as investors were forced to consider the implications of sustained inflationary pressures, the Russia-Ukraine conflict, and an increasingly hawkish U.S. Federal Reserve. Persistent inflation caused the market to discount more aggressive rate hikes and quantitative tightening from the Fed. Following the market selloff, the S&P 500 is still up 109% over the past 2 years and +48% since 12/31/19, despite the global pandemic.

Our expectation coming into the year was for heightened levels of market volatility. While we expect continued market swings in the near-to-intermediate term, the ongoing selloff has created attractive opportunities, particularly in high- quality stocks.

Looking out 12 to 18 months, we are constructive on equities as valuations are improving: the average stock has declined by over 20% from recent highs and certain measures of investor sentiment, a good contrarian indicator, have become quite negative. In addition, since 1946, the S&P 500 has never experienced a negative return in the 12 months following mid-term elections (November) and the average return for the index in the year following a yield curve inversion is +8.3%. Finally, if inflation begins to decelerate, history suggests solid returns over the coming 12 to 18 months.

As always, we welcome the opportunity to discuss how we can help clients to achieve their long-term financial goals.

Source: FactSet

Disclosures

The information provided is illustrative, for educational and informational purposes only, does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. All investments include a risk of loss that clients should be prepared to bear. The principal risks of Clarendon Private strategies are disclosed in the publicly available Form ADV Part 2A.

Clarendon Private, LLC (“Clarendon Private”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Clarendon Private and its representatives are properly licensed or exempt from licensure.