- Financial Insights

- News

- Commentary

- News & Commentary

- 35 min read

Clarendon Private Financial Insights - November 2021

With decades of investment management experience, we have lived through our share of bull and bear markets. Here we offer insights and perspectives on finance, the economy, and strategies for prudent investors in times of increased uncertainty and heightened volatility.

- By: Clarendon | PRIVATE

- November 01, 2021

Quarterly Review & Outlook Q3 2021 - Addressing Four Timely Questions

Is it too late to buy stocks?

Clarendon Private view: Not for investors with a multi-year time horizon. We maintain our longstanding view that we are in a secular bull market for U.S. equities.

What are your thoughts on tax hikes, Fed tapering, and potential market volatility?

Clarendon Private view: We expect higher volatility in the coming year due to decreasing monetary stimulus, policy uncertainty (tax hikes, debt ceiling debate), and inflation.

What is your view on Inflation or Stagflation?

Clarendon Private view: More than transitory, but not the 1970s.

Much ado about nothing... What happens to stocks after Tom Brady wins the Super Bowl?

Clarendon Private view: Regardless of whether or not one is a sports fan, a Tom Brady Super Bowl victory has historically preceded above average equity returns.

Market Review

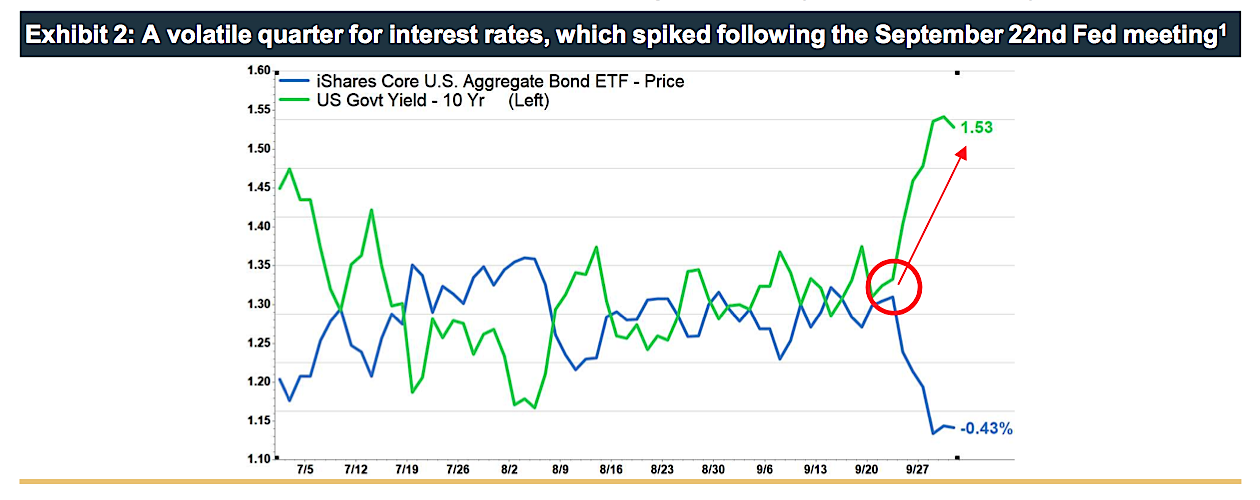

Following an 8.6% gain in the second quarter, the S&P 500 continued its advance during the third quarter (+0.58% total return), albeit with more muted performance and continued leadership from U.S. Large Cap Growth stocks. Non-U.S. markets declined with Emerging Markets -8.7% and the MSCI All Country US World Index (ex US) down -3.7% due to China’s sweeping regulatory reforms and Growth the potential Evergrande default. Volatility returned to the U.S. in the final weeks of Q3 amid fears of slowing economic growth and higher inflation, which halted the S&P 500’s 7-month streak of gains.

Clarendon Private LLC is a registered investment advisor and a subsidiary of Brookline Bancorp | Copyright 2021

1Source: FactSet

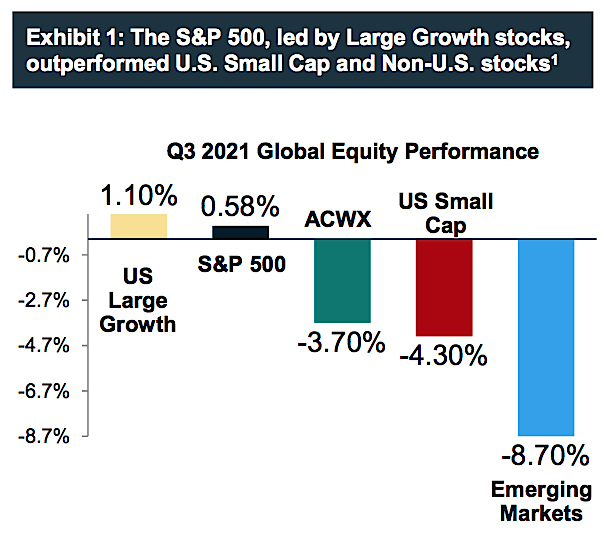

Interest rates were quite volatile during the quarter as the bond market digested the Fed’s tapering guidance and adapted to evolving expectations for economic growth and inflation. The 10-year U.S. Treasury yield plummeted from 1.47% to 1.17% during July due to investor concerns about the Delta variant and increasing political uncertainty (Exhibit 2).

The Federal Reserve held interest rates steady, and Chairman Powell noted that tapering “may soon be warranted” and that the Fed could “easily move” in November to announce a scaling back of its $120B per month bond buying program. The new dot-plot shows expectations for a rate hike in 2022, earlier than 2023 as excepted in the previous release. Subsequent to the Fed’s late September meeting, the 10-year yield surged 20 basis points in a week to 1.53% (a 30% yield increase from the August lows). The Bloomberg Barclays Aggregate Bond ETF declined -0.43% during Q3, and sold off sharply following the Fed meeting, consistent with our expectation for anemic bond returns given current yields and inflation dynamics.

Comparing the performance of market segments from Q1 and Q3 of this year reveals a tale of two markets. The first quarter of the year was characterized by classic early-cycle market action as the 10-year U.S. Treasury yield nearly doubled from 0.92% to 1.74% and the most cyclical (high beta and small cap) stocks led the market, while defensive (low volatility and quality growth) stocks underperformed.

1Source: FactSet

Outperformance of cyclical stocks is what we would expect earlier in the cycle as these companies offer greater earnings growth (off the bottom) relative to their more stable counterparts. Conversely, during Q3 mid-cycle dynamics were evident as investors rotated into low volatility and quality growth stocks which outperformed high beta and small cap.

Importantly, the middle stage of the cycle is characterized by a peak in the rate of growth, so investors tend to prefer higher quality stocks with sustainable secular growth at reasonable valuations. In this phase, market returns are typically driven by earnings growth as opposed to multiple expansion. This is often a great part of the cycle for stock pickers as equity correlations fall sharply which creates more idiosyncratic investment opportunities than the (macro-driven) early part of the cycle.

The world’s largest asset manager agrees. BlackRock (a leader in passive investments with $9.5 Trillion of total AUM) recently reported quarterly results and noted that over half of the $75 Billion of new inflows came from their actively managed funds. These results follow a decade in which the asset management industry witnessed net outflows in the U.S. of $2 Trillion from actively managed equity funds compared with passive equity fund inflows of $1.7 Trillion. CEO Larry Fink commented “A lot of people say, ‘active is dead,’ but I invested in more teams and products there.”

Higher volatility and mid-cycle conditions create tailwinds for active management. In addition, the potential changes to tax rates for individuals and corporations will likely provide us with opportunities to proactively harvest tax losses and reposition client portfolios. Given that we are in year 13 of the bull market, many clients need tax-efficient solutions to help manage risk and diversify portfolios with large embedded gains.

As the market transitions through the mid-cycle phase of the recovery and adapts to increasing inflationary pressures into 2022, we see the best opportunities being comprised of (1) high quality businesses with pricing power and stable free cash flow growth (2) companies with the ability to increase returns of capital to shareholders (3) a portfolio that contains some dry powder and is balanced with a blend of secular growth leaders as well as high quality cyclicals positioned to benefit from a strong consumer, pent up demand, and inflation.

1Source: Cornerstone Macro

Addressing Four Timely Questions

Question 1. Is it too late to buy stocks?

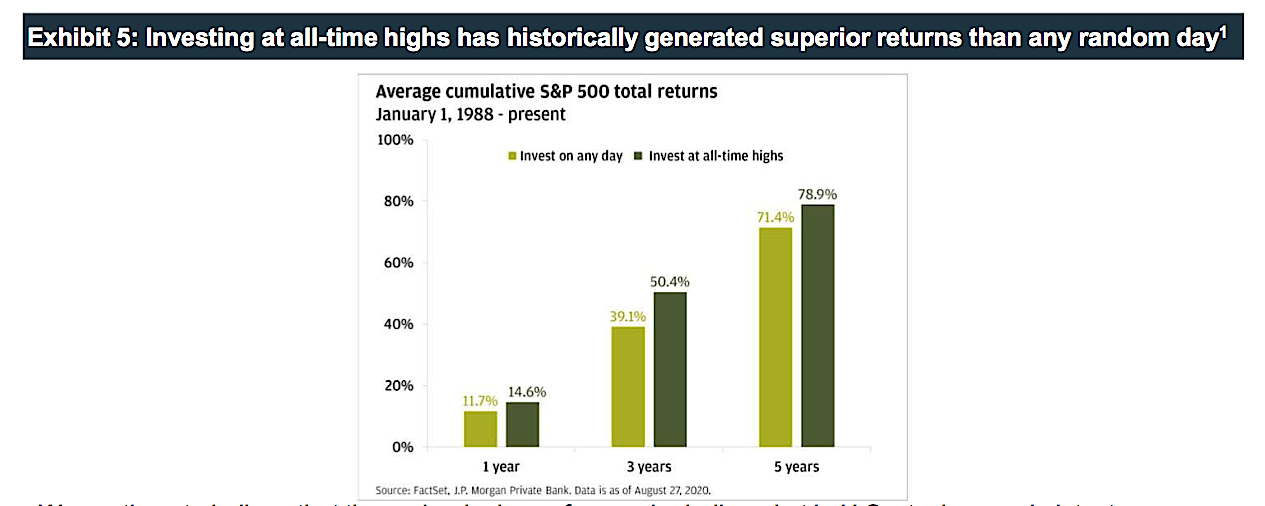

Clarendon Private view: Not for investors with a multi-year time horizon. Prospective U.S. equity returns in the next 5 years are likely to be lower than the out-sized gains over the past 12 years (+18% per annum) but still offer an attractive risk to reward ratio, particularly versus cash and bonds.

We continue to believe that the underpinnings of a secular bull market in U.S. stocks remain intact. Counterintuitively, investing at all-time highs has historically generated superior returns than investing on any random day (Exhibit 5). Ultimately, this speaks to the power of sustained price momentum in a long- term uptrend. COVID-19 created a significant exogenous shock for the global economy, but we view this reset of the cycle as extending the bull market that, in our view, began in March 2009. Historically, these long uptrends have lasted 15-20 years and compounded at double-digit rates of return (we are only in year 13). It is normal and healthy to experience multiple corrections of 20% or more, which can present great buying opportunities for disciplined investors during these periods.

1Source: J.P. Morgan Private Bank 2Source: Morgan Stanley, FactSet

The secular bull market should continue to be supported by fundamental tailwinds from monetary and fiscal stimulus, a strong U.S. consumer, and pent up global demand. Other key tenets of our long-term thesis include:

-

The magic of the American system: Companies are adapting and finding new ways to attract customers and employees while paving the way for new secular growth opportunities. Warren Buffett has often referred to this spirit of innovation as the “American magic” that has long fueled our economy. In many ways, COVID has accelerated the transition to a digital economy with increased adoption of e- commerce and demand for remote connectivity. While the path forward will be nonlinear, we believe it will undoubtedly be shaped by the American magic of innovation.

-

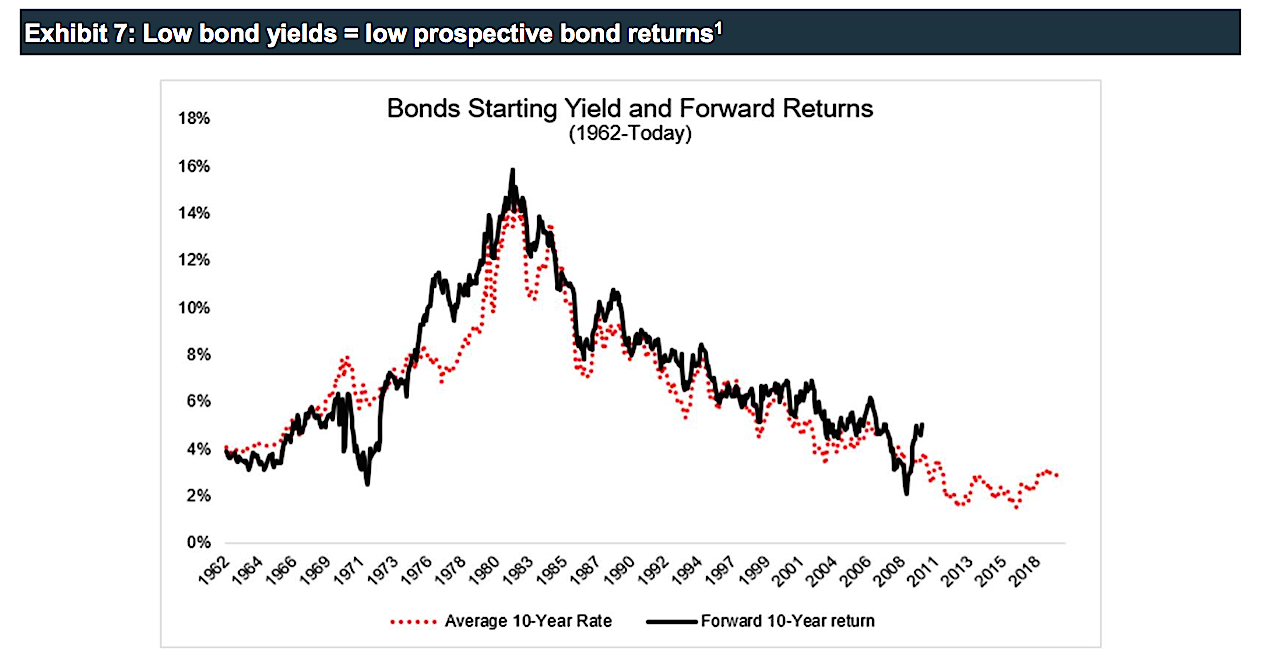

Low interest rates continue to support equity valuations: Unprecedented monetary and fiscal stimulus deployed over the last 18 months has supported the economy in the wake of the global pandemic. Despite recent volatility, and imminent (but gradual) Fed tapering, interest rates remain at multi-generational lows. As a result of this lower-for-longer interest rate environment, prospective returns offered by bonds and cash (net of inflation and taxes) remain anemic at best. For example, the yield on 5-year U.S. government bonds was a paltry 0.99% at quarter end. After adjusting for taxes and inflation, “real” yields are negative.

Bonds can provide ballast in balanced portfolios, but investing is about opportunity cost and (the cost of) holding cash and bonds has rarely been higher. This is particularly relevant for long-term investors seeking to preserve purchasing power. Today investors are faced with limited options, apart from equities and alternatives, from which to responsibly compound wealth net of fees, taxes, and inflation.

1Source: The Irrelevant Investor

There has been a paradigm shift in equity valuations since 2009 - post the Great Financial Crisis (GFC) - which is evident in Exhibit 8. In our view, this is a byproduct of the unprecedented central bank monetary policy since 2009.

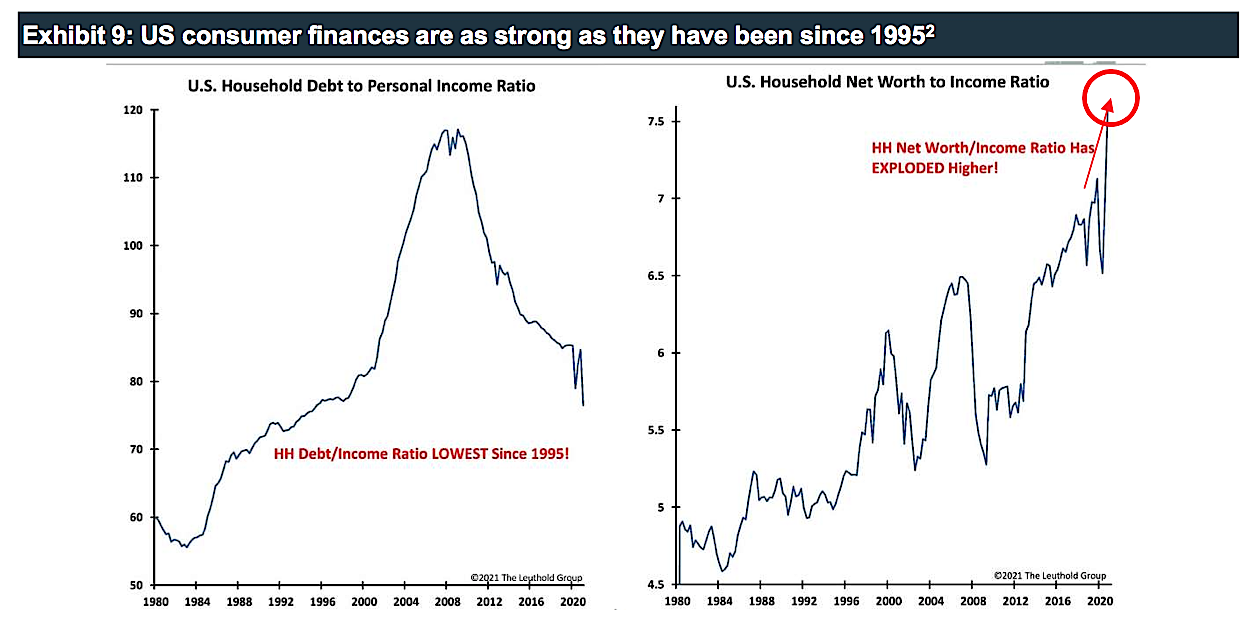

3. U.S. consumers have never been stronger and they drive nearly 70% of the economy: Key gauges of U.S. consumer health suggest a tailwind to sustained economic growth into 2022 despite less accommodative monetary policy. Wages are growing, unemployment is 4.8%, debt to income service ratios are the strongest they’ve been since the 1990s bull market, and household net worth has reached an all-time high. In addition, record levels of investor cash remain on the sidelines with personal savings as a percent of GDP at 17%, more than double the long-run average. At the same time, durable goods spending as a percent of GDP sits near record lows at 7% versus an 8-9% long- run average (pent up demand).

1Source: Wolfe Research 2Source: The Leuthold Group

Question 2: What are your thoughts on tax hikes, Fed tapering, and potential market volatility?

Clarendon Private view: We expect higher volatility in the coming year due to decreasing monetary stimulus, policy uncertainty (tax hikes, debt ceiling debate), and inflation.

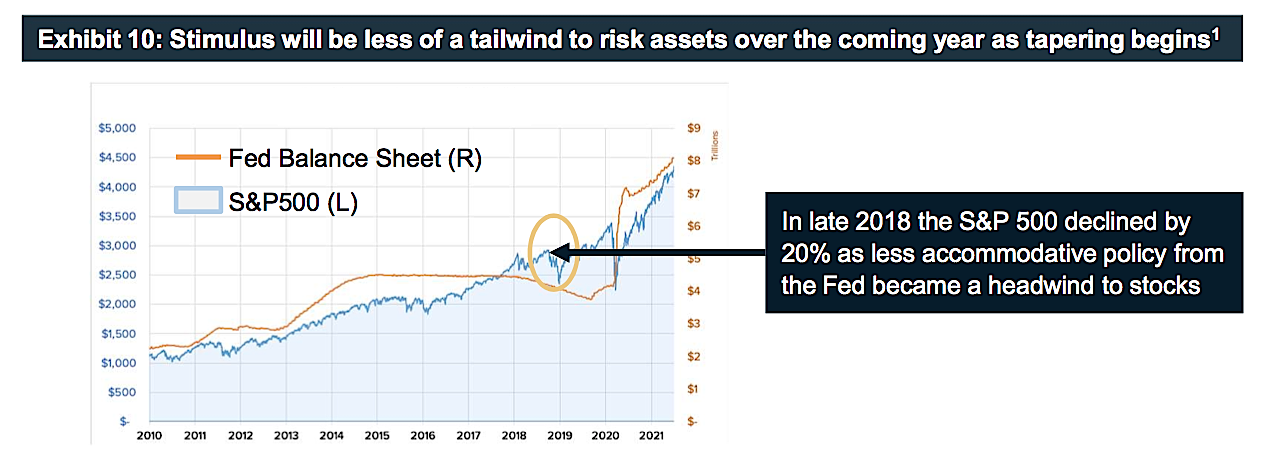

Central bank bond buying (QE) will continue into 2022, but at a declining rate. We view this as a headwind to equities in the coming months, similar to 2018, which led to a 20% correction in the S&P 500 (Exhibit 10). Tax hikes and higher inflation will likely also reduce earnings growth and equity valuations in the coming year. As part of our active management process, we will look to take advantage of the volatility we expect in the coming months to employ tax loss harvesting and opportunistically reposition portfolios.

Following a year of historic market volatility in 2020, the market had been uncharacteristically calm during the first eight months of 2021. On average, the S&P 500 Index has experienced nearly 3 pullbacks of 5% in a given year since 1950. Dating back to September of 2020, the index returned 29.4% and went 227 trading days (until September) without a 5% decline, the fourth-longest streak in 50 years. In stark contrast, the S&P 500 experienced 10 days with greater than 5% (intra-day) price changes during the first half of 2020 alone.

Going forward, we expect volatility to normalize (increase) as we move beyond the peak rate of change from stimulus and earnings growth - key market tailwinds that prevailed during the recent period of low volatility.

While unnerving, volatility has historically presented great opportunities for disciplined investors. Our long- term approach enables us to capitalize on the time arbitrage opportunities created by behavioral-driven market dislocations. An integral part of our investment process is that we focus on increasing our exposure to attractively priced assets and high-quality businesses, particularly during periods of market stress and indiscriminate selloffs. Importantly, missing just the 5 best days of any given year in the market can be enormously costly (Exhibit 11).

1Source: Federal Reserve Bank of St. Louis. Data through July 2021.

Furthermore, according to J.P. Morgan Asset Management the “Average Investor” has returned just 2.9% per annum during the same 20 years (ended 12/31/20) versus 6.4% for a “static” 60/40 portfolio. The subpar returns achieved by the average investor are ultimately the result of market timing and the perils of buying high and selling low. One of our key responsibilities to clients is to adhere to our disciplined investment process and help them to be opportunistic as opposed to reactionary to the inevitable vicissitudes of the markets (Exhibit 12).

Question 3: What is your view on Inflation or Stagflation?

Clarendon Private view: More than transitory, but not the 1970s.

In January of this year (when the 10-year U.S. Treasury bond yielded just 1.1% and the 5-year breakeven inflation rate was 2.1%) we highlighted the potential for an inflation/rate scare as one of the most underappreciated risks in the markets at the time. That view is now consensus as rates and inflation have both increased. Given the impact that inflation and interest rates have on asset valuations, it is critical to understand the drivers and outlook for both.

1Source: BlackRock 2Source: J.P. Morgan Asset Management

As of quarter end, the 10-year U.S. Treasury bond yielded 1.53% and the 5-year breakeven inflation rate had increased to 2.5%. The breakeven rate is the difference between the rate on (5-year) Treasuries versus the yield on TIPS (inflation protected securities) and captures investor expectations for inflation over the coming 5 years. The market has come around to the view that inflation expectations and yields had been too low relative to the dramatic economic recovery. Over the past few quarters, investors have begun to recognize the pricing pressures created by a confluence of factors: exponential policy-driven demand growth that has overwhelmed the concomitant labor and product supply shortages.

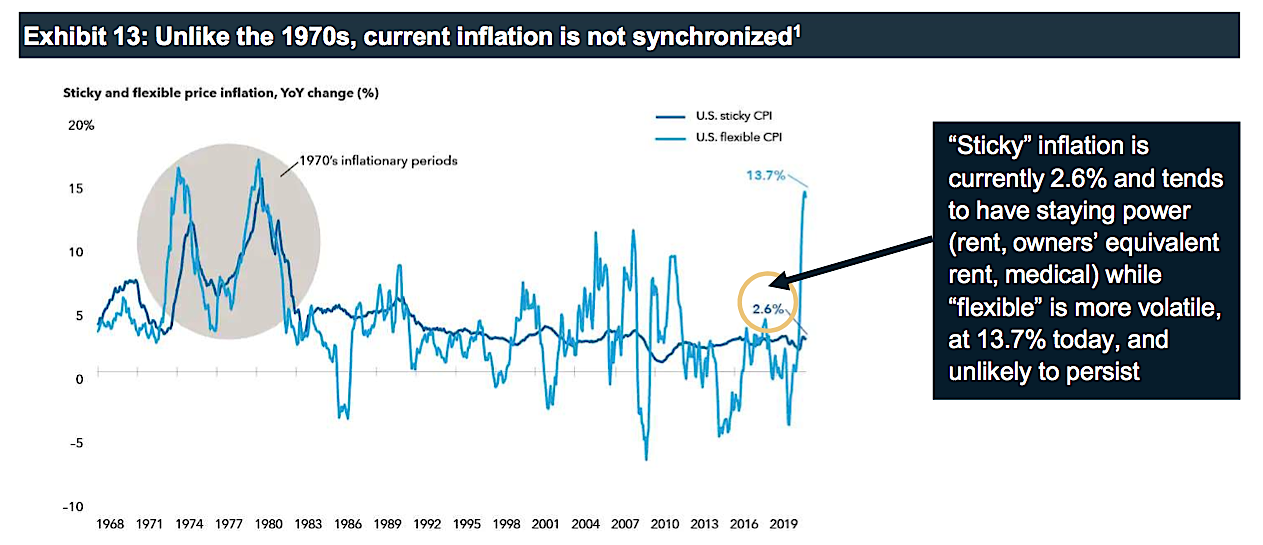

Inflationary pressures have steadily increased in 2021 (CPI was +5.4% in September, on track for the largest increase since the 1990s) and led to widespread calls for Stagflation. A recent J.P. Morgan survey of investors revealed that 42% of respondents believe we are headed for Stagflation. The term gained popularity in the 1970s during a period of (1) high inflation (2) subpar growth and (3) persistently high unemployment.

We have experienced a global energy shock (natural gas prices have more than doubled in 2021) which is contributing to a spike in “flexible” inflation. Our view is that “sticky” inflation, which is currently 2.6% (in-line with 5-year breakeven inflation rates) offers a better sense for potential U.S. CPI looking out a year from now (Exhibit 13). Flexible inflation is up 13.7% due to spikes in energy, food, and auto prices that were exacerbated by COVID driven supply shortages. Prices have already come down significantly in some categories (lumber prices have collapsed by 60% since May) and our view is that a gradual normalization of the pervasive supply/demand imbalances will cause these cyclical pricing pressures to abate over the next 18 months.

Besides sustained high inflation, other key inputs to create Stagflation are subpar growth and persistent unemployment. The fundamentals do not support this view. It is important to consider that the U.S. consumer has never been stronger, and the employment picture is solid and improving - with record job openings, strong wage gains, and a low/declining unemployment rate (4.8%). Accommodative monetary and fiscal policy combined with multi-decade lows in capital expenditures and inventories should also provide a tailwind to global growth.

1Source: Capital Group

To be sure, we expect inflationary pressures to continue into 2022 (and remain higher than trends seen over the past several years) but pricing pressures should gradually moderate from current levels. Improving COVID cases and the fading Delta wave will ultimately help alleviate supply chain bottlenecks. With Delta disruptions fading, extended unemployment benefits ending, and schools open, labor supply should improve, logistics shortfalls ebb, and wage pressure subside. If higher inflation reduces demand for goods, price pressures should also abate in a self-correcting cycle.

The U.S. central bank will likely begin tapering assets before year end and could be completed by the middle of next year. If inflation proves more persistent in areas like rent, housing, and services, the Fed may be compelled to raise rates next year as well. Importantly, if investors think that high inflation will induce the Fed to capitulate and raise rates earlier than expected, the yield curve will likely come under flattening pressure.

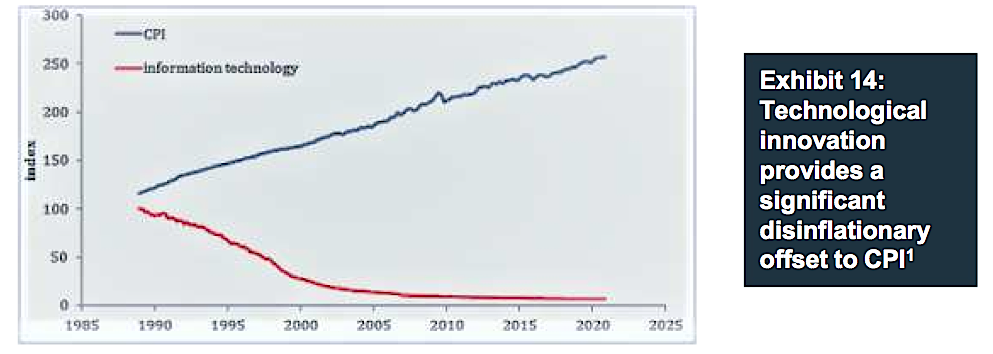

While we continue to see inflationary pressures as the key risk over the coming year, we maintain our view that there are key structural offsets to sustained high inflation for a multi-year period. The dis-inflationary and productivity-enhancing impact from technological innovation is central to our view (Exhibit 14). The proliferation of technology over the last decade has led to significant societal benefits and improved productivity.

Our increasing digital footprint (e-commerce, Cloud-based storage, ride-sharing, social media, and streaming, just to name a few examples) is driving significant demand for data as well as engineering and tech-oriented expertise across industries. This has led to above-average employment growth in tech-related jobs. As such, we maintain our longstanding view that the productivity enhancements from the digitization of the economy continue to provide a long-term offset to the building medium-term inflationary pressures.

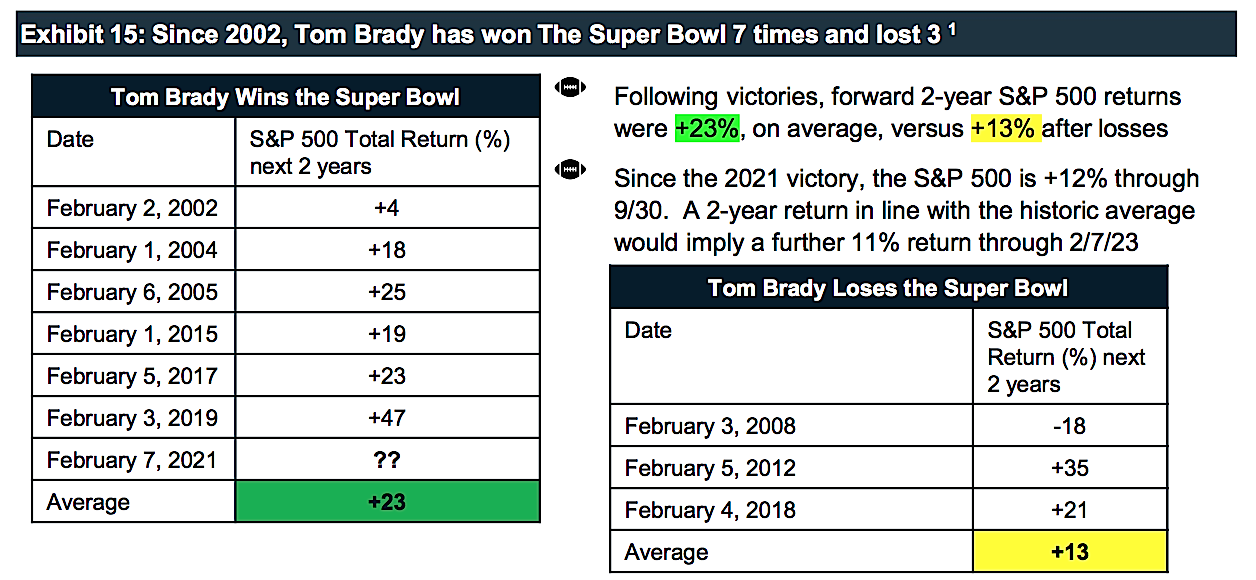

Question 4: Much ado about nothing... What happens to the stock market in the two years after Tom Brady wins the Super Bowl?

Clarendon Private view: Regardless of whether one has an interest in sports, is a fan of Tom Brady (Tampa Bay Buccaneers) or The New England Patriots, a Tom Brady Super Bowl victory has historically preceded above average equity market returns in the subsequent 2 years.

The former New England Patriots’ Quarterback won his 7th Super Bowl earlier this year, and we asked ourselves “what might this imply for equity returns over the next few years?” Although another Tom Brady victory might not please everyone, our analysis revealed that it has typically been a precursor to a positive outcome for U.S. equity investors over the subsequent 2 years (Exhibit 14).

1Source: U.S. Bureau of Labor Statistics

Conclusion

U.S. equities advanced in Q3 despite headline risks that included higher inflation, political uncertainty, the Delta variant, and slowing growth. Non-U.S. stocks declined and continue to underperform due in part to China’s sweeping regulatory reforms, the potential Evergrande default, and a strengthening U.S. Dollar. Interest rates were highly volatile and 10-year U.S. Treasury yields spiked by 30% from the August lows following the Fed meeting in late September. Bonds can provide ballast in balanced portfolios, but prospective real (inflation-adjusted) returns from bonds remain anemic at best.

During the quarter we witnessed a significant rotation in equity market leadership from earlier in the year as mid-cycle dynamics prevailed. This caused investors to favor low volatility and quality growth stocks, which outperformed (more cyclical) high beta and small cap equities that led earlier in the year. Importantly, this stage of the cycle is characterized by a peak in the rate of growth and is a great backdrop for active management as equity correlations fall sharply - which creates more idiosyncratic investment opportunities than the (macro-driven) early part of the cycle.

Accommodative policy, healthy U.S. consumer balance sheets, pent up demand, and technology-driven productivity gains should sustain the economic expansion. While we expect pricing pressures to remain above trend in 2022, we do not view this as the beginning of a Stagflationary period like the 1970s.

Market volatility is likely to increase in the coming year and we will look to take advantage of market weakness to (1) harvest tax losses to reposition portfolios and (2) increase exposure to quality businesses and asset classes at attractive valuations. Prospective returns from equities and alternatives are superior to bonds and cash, albeit lower than the robust returns of the past decade.

As always, we welcome the opportunity to discuss how we can help clients to achieve their long-term financial goals.

Disclosures

Clarendon Private LLC ("Clarendon Private") is a registered investment advisor with the U.S. Securities and Exchange Commission ("SEC"). The content in this market outlook is for educational and information purposes only and is not intended to be investment advice nor a recommendation to buy or sell any investment or take any specific action. Clarendon Private provides investment advice on an individualized basis specific to one's unique situation. The information herein is derived from numerous sources, which are believed to be reliable. However, Clarendon Private does not audit the information from these parties. Information is also at a point in time and subject to change without notice.